Should Your Industry Advertise in AI Media in 2026?

These four categories need to act now: Travel, retail, health and electronics

Every industry category should have a plan for testing ads in AI media, but not every industry needs to pull the trigger now. My exclusive analysis of search ad spending data + consumer AI behavior reveals why travel, retail, health and electronics advertisers must start today.

TL:DR

Four categories should put AI media on the front burner in 2026: Travel, retail, healthcare/pharma and technology/electronics. But the reasons why are not the same for each category.

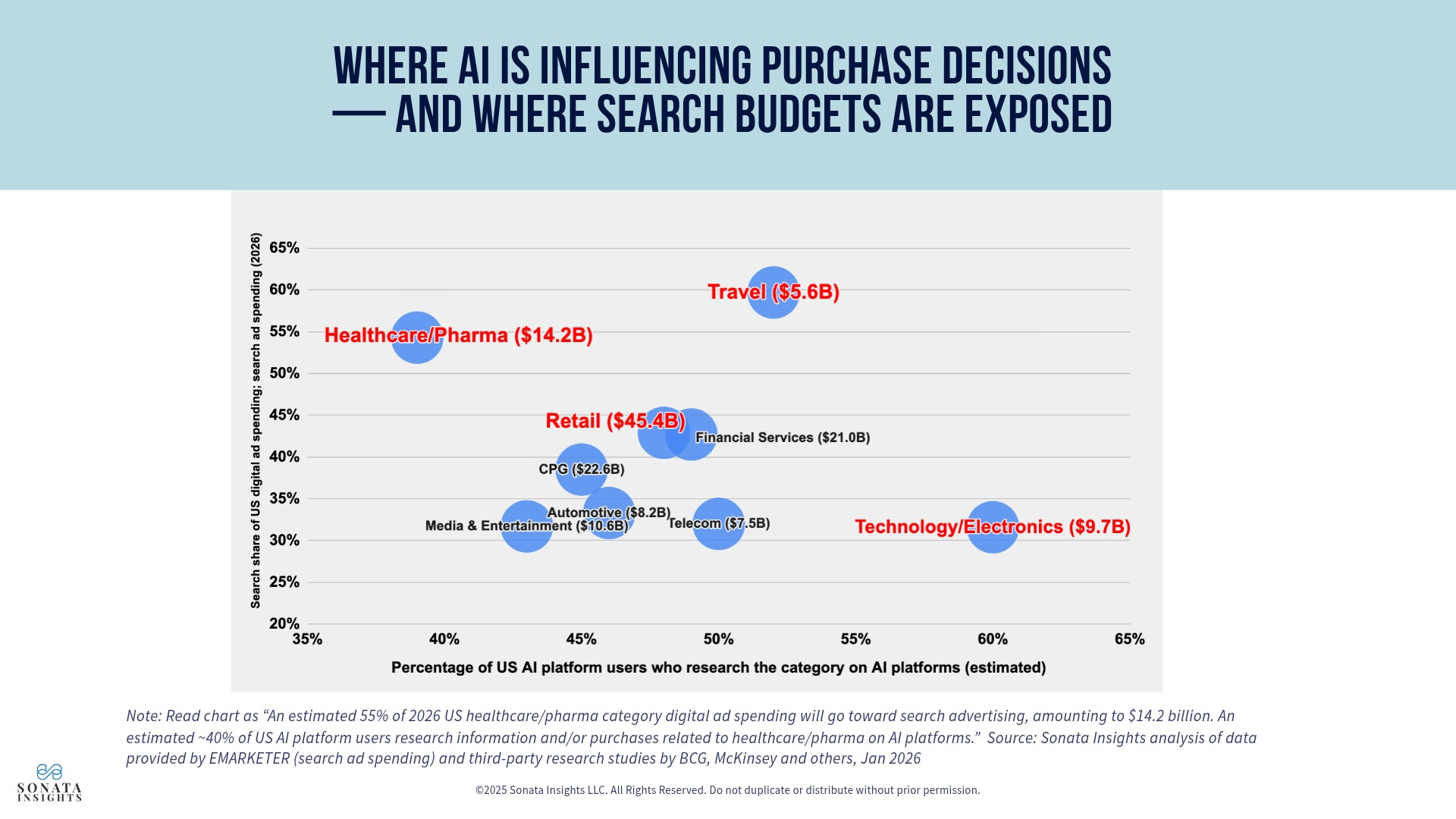

I conducted an analysis of search ad spending across 9 industry categories (using data provided by EMARKETER) alongside third-party survey data that examines how consumers use AI platforms for research and purchase decisions (scroll to the bottom for the full Methodology).

In this article, I explain:

Why retail, travel, healthcare/pharma and technology/electronics advertisers should invest in AI media now

Which consumer AI behaviors in these categories stand out

How the typical ad strategies and objectives that travel, retail, healthcare and technology/electronics advertisers use map to AI media

Why marketers in consumer packaged goods (CPG), automotive, financial services, media/entertainment and telecom can take a slower (but not too slow) approach

Here’s what else is in this week’s issue:

Consumer Behavior to Watch

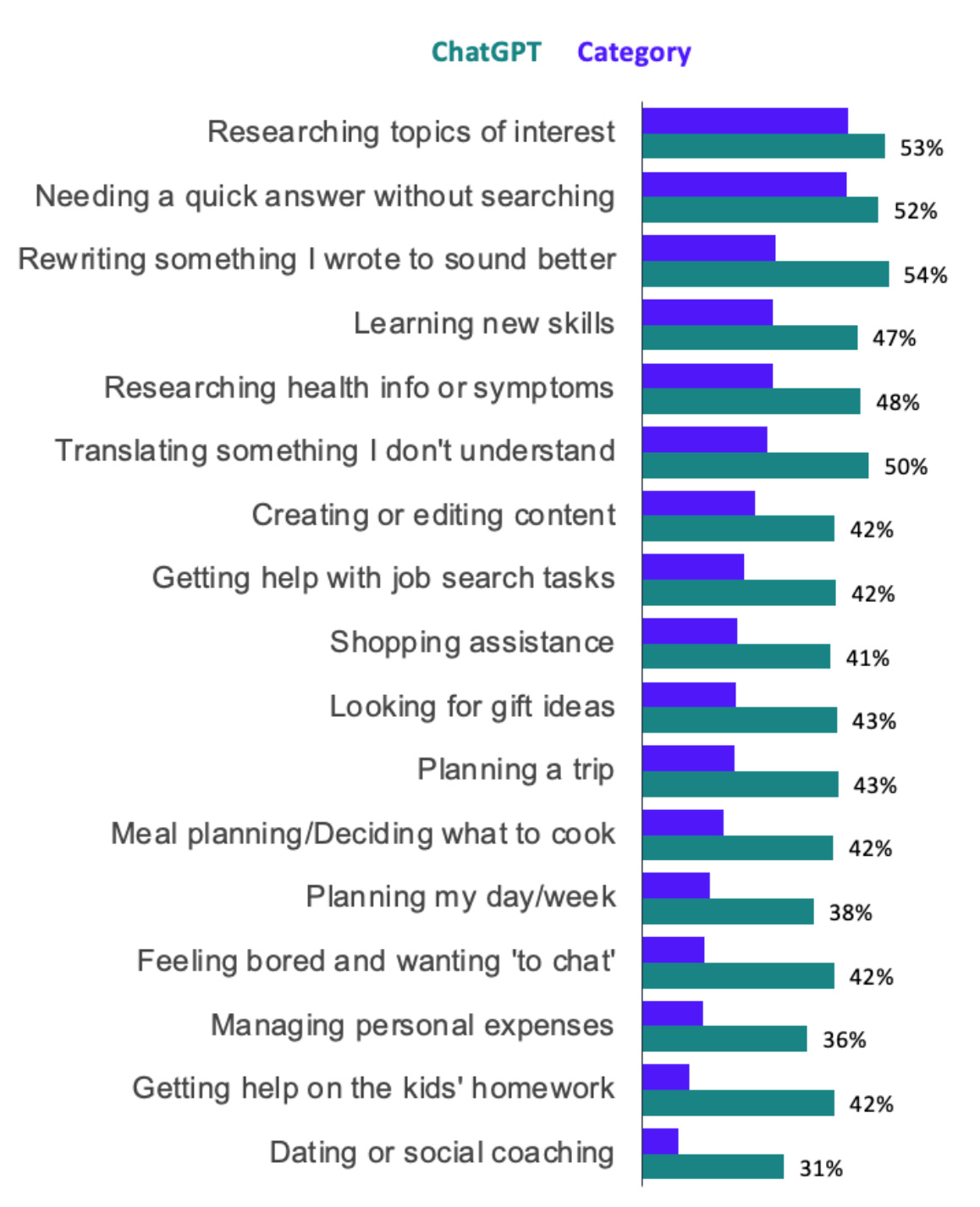

More than half of US adults use ChatGPT to get a quick answer without searching, according to a new study of AI chatbots by Morning Consult.

AI Ad News from the GOMMA

A crisp, curated roundup of AI Ad Economy news related to Google, OpenAI, Meta, Microsoft and Amazon.

Ok, let’s dive in …

WHICH INDUSTRY CATEGORIES SHOULD INVEST IN PAID AI MEDIA FIRST?

After the big news that ChatGPT is going to start selling ads, many advertisers were left wondering: Should I test ads in AI media?

The short answer is yes. But how quickly you move depends on your industry category.

This article is the second in a 4-part series designed to help advertisers decide when, where and how to invest in paid AI media.

Read Part 1: Should You Have an AI Media Budget? A Decision Framework for Advertisers.

Coming soon:

Is Your Organization Ready to Experiment with AI Media?

How Can Your Organic AI Presence Support Paid Advertising?

Three factors help determine an industry category’s readiness for AI media:

What percentage of consumers are using AI platforms to research information or purchases related to an industry category? The more your audience is gravitating toward AI, the more likely it is that you need to be there.

How much does the category spend on search advertising on an annual basis? Many advertisers use search as a proxy for understanding AI, so they are most likely to pull from search budgets first to fund paid AI media.

What share of a category’s digital ad spending goes toward search vs. other formats, such as display? Because most current AI ad formats are lower-funnel, a heavier weighting toward search advertising indicates greater category readiness.

My exclusive analysis of search ad spending data from EMARKETER and consumer AI usage data from multiple surveys shows where each of nine major industries falls in this matrix.

My analysis shows that four categories stand out from the others:

Retail

Travel

Healthcare/pharma

Technology/electronics

(A fifth category, financial services, is very close, but doesn’t quite meet the criteria. More on that later.)

Here’s why AI media should be top of mind for all four industry categories right now.

Retail

Why AI media should be on the front burner: High search ad spending and significant consumer AI usage.

Retailers will spend $45.5 billion on search advertising in 2026, by far the most of any industry category, according to EMARKETER’s forecast. 43% of total retail category digital ad spending will go toward search, the third-highest share among all industry categories.

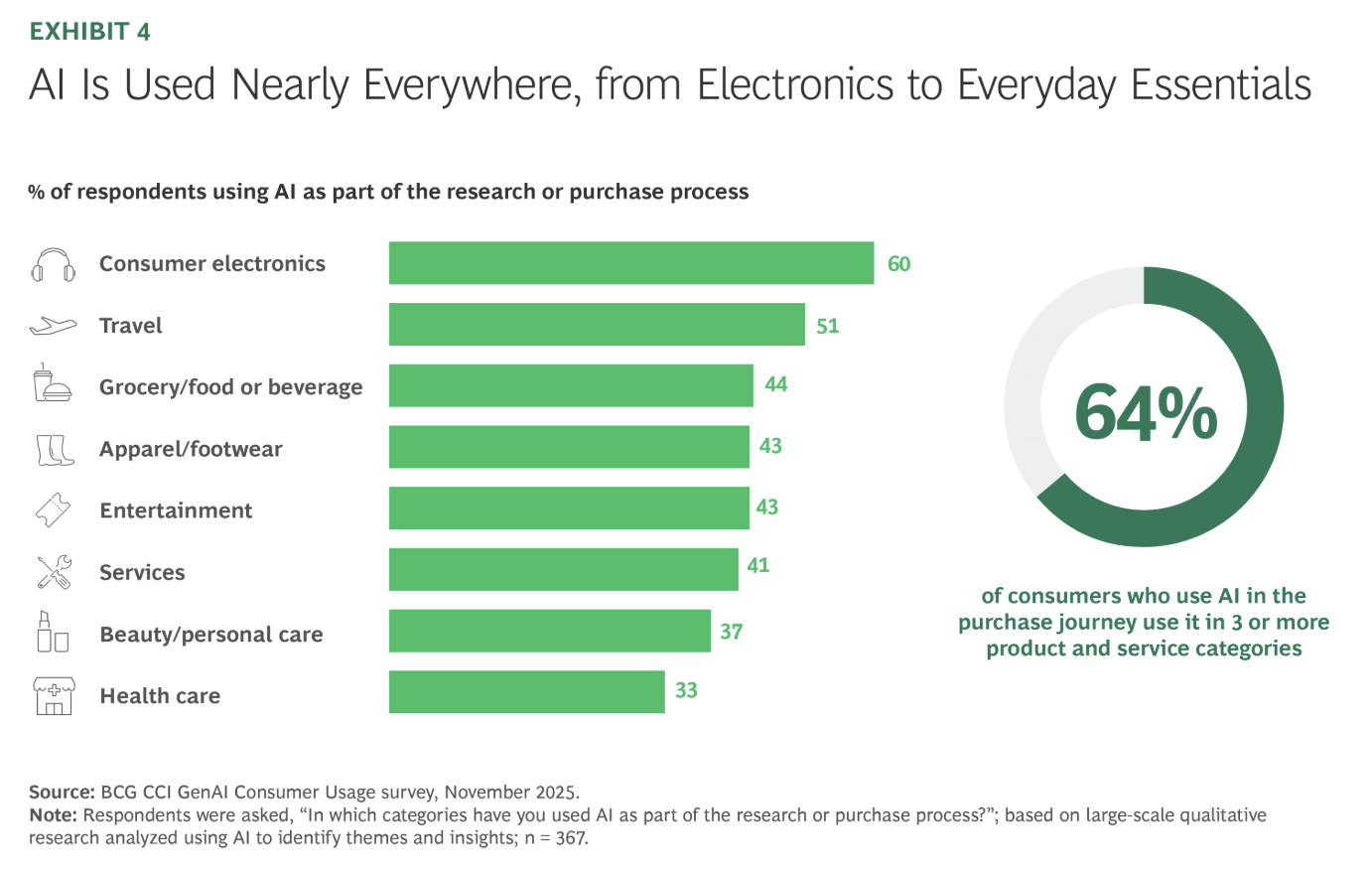

Key consumer behaviors: 49% of US adults have used AI to make retail & CPG purchasing decisions, according to data from First Page Sage. Consumers who visit retail sites after using generative AI sources show 8% higher engagement compared to consumers who come from non-AI sources, according to Adobe. They also browse 12% more pages per visit and have a 23% lower bounce rate.

Typical ad objectives and strategies: Retail advertisers heavily rely on lower-funnel, performance-based advertising, aimed at driving immediate conversions and capturing high-intent demand. Messaging is typically price-led, with clear calls to action (CTAs).

AI media alignment: By deploying AI media ad units, retailers can experiment with new methods to drive traffic to retail destinations, deliver discounts or other offers, and spark interest and demand from consumers. Their objectives align well with AI environments that feature comparisons, deals and product recommendations, and AI ad formats such as Google’s Direct Offers, a retail-focused product.

Travel

Why AI media should be on the front burner: Extremely high share of digital spending going toward search and significant consumer AI usage.

Travel is one of the smallest industry categories, spending an estimated $5.55 billion on search this year according to EMARKETER. But that amounts to 60% of the category’s total digital spending, making travel the top category based on this metric.

Key consumer behaviors: Among US adults who use AI as part of the purchase journey, 51% research or plan travel purchases with the help of AI, according to BCG. The top use cases include general research (54% of respondents), travel inspiration (43%) and local food recommendations (43%), an Adobe survey found. Consumers who use AI are also further along in the decision process; when they visit a travel site after using an AI platform, they have a 45% lower bounce rate compared to non-AI sources.

Typical ad objectives and strategies: Travel advertisers want to influence planning and consideration and capture booking intent at or near the point of decision. Using advertising visuals that balance emotional storytelling with utility, travel advertisers focus on mid- to lower-funnel strategies that aim to shorten consideration windows.

AI media alignment: Travel advertising aligns well with AI use cases such as trip planning, itinerary building and comparison shopping. Advertising in AI platforms can help consumers to make quicker decisions, especially if the ads contain high-value offers. In the future, the ability to connect back-end data from travel loyalty programs will inform AI ad targeting and personalization, driving higher clicks and engagement.

Healthcare and Pharma

Why AI media should be on the front burner: Very high share of digital spending going toward search, double-digit search ad spending and smallish but growing consumer usage.

Healthcare and pharma advertisers will devote 54% of total digital ad spending to search ads in 2026, amounting to $14.19 billion, according to EMARKETER’s forecast.

AI consumer behaviors: Although the percentage of AI users who turn to AI platforms to gather information or make purchase decisions is lower than for other categories (33% according to BCG, compared to 51% for travel), platforms like ChatGPT are starting to see increased consumer activity. According to OpenAI, three in five US adults have used AI tools for their health or healthcare in the past three months.

Typical ad objectives and strategies: Healthcare and pharma advertisers are more focused on the upper funnel than travel or retail advertisers, and their search advertising strategies are often aimed at education and brand safety. Their messaging seeks to align with disease states and symptoms rather than making direct brand claims.

AI media alignment: Consumers who use AI platforms to research symptoms and treatments move from education to action much more quickly than in search environments. This provides health/pharma advertisers an opportunity to experiment with ad units that provide trusted brand signals within or adjacent to answers.

Technology and Electronics

Why AI media should be on the front burner: Extremely high consumer AI usage.

Technology/electronics advertisers are much less reliant on search advertising than travel, retail or healthcare/pharma advertisers, allocating an estimated 32% of 2026 digital ad budgets to search, for a total of $9.65 billion in spending. But consumer AI usage is higher than in any other category, indicating that advertisers should act now to boost organic presence in AI, while simultaneously starting to invest in AI media to capture existing consumer demand.

AI consumer behaviors: Among US adults who use AI as part of the purchase journey, 60% research or plan electronics purchases with the help of AI, according to BCG. That usage rate was higher than any other category BCG studied. An August 2025 study by McKinsey backs this up; it found that 55% of AI platforms users used AI to learn about or make decisions about consumer electronics purchases in the past 3 months before the survey.

Typical ad objectives and strategies: Tech/electronics ads need to support complex, sometimes lengthy purchase decisions. Mid- and lower-funnel ads help consumers toward research and trial goals. Creative often focuses on features, comparisons to competing products and third-party proof points.

AI media alignment: Because these advertisers heavily rely on research-driven discovery, there is significant overlap with AI use cases such as comparison, troubleshooting and buying guidance. For this category, a strong organic AI presence will be critical. That forms the foundation on which advertisers can build an ad strategy that will help users evaluate tech tools and electronics purchases.

Can Other Industry Categories Wait?

Financial services is a category that’s on the bubble. Consumer AI usage is nearly identical to that of retail, and 43% of category budgets go toward search, pert EMARKETER — also identical to retail. However, total search spending by financial services advertisers is about half that of retail, at $21.0 billion in 2026. Some advertisers could make the case for moving quickly into AI media while others (especially those who are more risk-averse) could stand down.

For every other category I studied, consumer usage of AI is quite high, especially for telecom. That fact alone could be a signal to invest in AI media. But these categories generally allocate a lower percentage of digital ad budget to search — about 30% to 40%, according to EMARKETER — and more to higher-funnel display formats.

It could be argued that less reliance on search means less friction when it comes to shifting budgets, but the challenge is that early forms of AI media advertising are mostly lower-funnel. That structurally disadvantages categories like automotive, CPG and media/entertainment, which are more focused on the upper funnel. The AI ad formats haven’t been built for them yet.

For these categories, waiting to deploy paid AI media can be considered a strategic choice, not a failure to innovate.

Key Takeaways

Paid AI media isn’t just another platform to test. It reflects a shift in how consumers express and act on intent.

Travel, retail, healthcare/pharma and technology/electronics advertisers should start investing in paid AI media today.

These four industry categories have the strongest blend of existing consumer AI behavior and search advertising usage.

Advertisers in other industry categories, such as CPG and automotive, can take a slightly slower approach. As upper-funnel ad opportunities emerge, they should be prepared to start experimenting.

Next: Is Your Organization Ready to Experiment with Paid AI Media?

Marketing organizations need to have the right mindsets, tools and talent to execute AI media experiments. Next in the Should You Have an AI Media Budget? series, I’ll discuss how to ensure marketing departments and agency partners are aligned internally for success.

Methodology

This article is based on an analysis of two types of data:

1) US digital ad spending forecasts provided to me by EMARKETER, broken out by ad format and industry category. EMARKETER forecasts ad spending for the nine categories included in this analysis. It breaks out spending in each category for search, display and other formats (classifieds/directories, lead generation, email, mobile messaging). I worked for EMARKETER for 19 years and have 100% confidence in their forecasts.

2) US consumer AI usage data from multiple surveys. I gathered survey data from a variety of publicly available sources, including BCG, McKinsey, Adobe, OpenAI, J.D. Power, First Page Sage, Cognizant and Cars.com. The dataset includes statistics related to US consumers’ use of AI platforms to research and/or make purchase decisions in industry categories.

I used the EMARKETER data to calculate the share of 2026 US digital ad spending going toward search for each category. I also used EMARKETER’s estimate for total search ad spending (in dollars) for each category.

Next, I analyzed the consumer survey data and normalized it, where possible, to the US AI user audience. I then developed estimates of the percentage of US AI users in each category who use AI to gather information or research purchases.

Finally, I constructed a chart that compares search’s share of spending for each category to the estimated percentage of consumers using AI tools in each category. Total search spending provides a third layer of detail to inform the analysis.

CONSUMER BEHAVIOR TO WATCH

New data from Morning Consult shows that US adults are significantly more likely to use ChatGPT than other AI platforms as a category for every task asked about.

AI AD NEWS FROM THE GOMMA

What’s the GOMMA? Here’s a curated set of recent AI Ad Economy news from Google, OpenAI, Meta, Microsoft and Amazon.

Google

DeepMind CEO “surprised” OpenAI moved so fast on ads (Axios) — Google’s public stance is becoming clearer: monetize AI inside Search where intent is legible and keep Gemini cleaner for trust. That split will shape where advertisers get volume and where “assistant brand safety” norms get defined.

OpenAI

OpenAI to Begin Testing Ads in ChatGPT in Push for Fresh Revenue (WSJ) — OpenAI is building guardrails early by limiting ads to Free and Go tiers and excluding sensitive categories. The big implication is segmentation: advertisers may get reach, but premium users could become an ad-free “high value” cohort.

OpenAI to start offering chatbot ads to advertisers, The Information reports (Reuters) — The advertiser-side rollout is moving from theory to inventory with an early February trial and view-based pricing. That points to a TV-like buying mindset, but it also sets up a measurement fight over incrementality in conversational journeys.

Microsoft

Microsoft CEO warns AI needs to spread beyond Big Tech to avoid bubble (Seattle Times) — Satya Nadella said at the Economic Summit that for AI’s growth to be sustainable it must extend past major tech firms into wider industry and global use, or the hype could cause a market bubble.

Meta

Why Alphabet and Meta investors shouldn’t sweat ChatGPT’s ad launch — for now (MarketWatch) — Analysts say ChatGPT’s initial ad tests on free and Go tiers won’t meaningfully threaten Google or Meta’s core ad businesses this year given incumbents’ scale and distribution advantages, though long-term shifts in discovery and commercial queries merit watching.

Amazon

Walmart says ‘open partnerships’ are central to its AI strategy, while Amazon goes it alone (Digiday) — The contrast matters for brands: Walmart is signaling interoperability, while Amazon’s closed approach protects data advantage and retail media margin. If AI shopping assistants become a new front door, Amazon’s lock-in could become the real moat.

Looking for news about AI and advertising on a daily basis? Check out Tipsheet.ai, from John Ebbert. It’s one of my must reads.

WHAT’S DEBBIE UP TO?

The research I’m working on, where you can catch me on stage and when I’m quoted in the media.

Research

NEW! IAB + Sonata Insights: The AI Ad Gap Widens (plus, read our 2024 study here)

NEW! Mediaocean: 2026 Advertising Outlook Report (I wrote the foreword)

On Stage

Jan. 28, 2026, 1pm: “The Mediaocean Current: 2026 Advertising Outlook” (sign up for the webinar here)

Feb. 2, 2026: “Building Trust Through AI Transparency” at IAB’s Annual Leadership Meeting, Palm Desert CA

March 26, 2026, 2pm: “Reinventing Brands for the Next Generation” at Shoptalk Spring, Las Vegas NV

In the Media

SUPPORT THE AI AD ECONOMY

Do research with me. I’ve worked with companies including WARC, IAB, Datos, The Rebooting and Ascendant Network to develop and publish thought leadership research that helps them stand out in the crowded AI space. Visit my business website Sonata Insights to learn more.

Invite me to speak. I deliver keynotes and panel discussions at public and private events. So far this year I’ve been on stage at Cannes Lions, Advertising Week, Coalition for Innovative Media Measurement, Beet.tv, Seattle AI Film Festival, Reddit and more. Watch my speaking reel.

This is a really clarifying way to think about timing by category, especially separating “should test” from “must move now.” One nuance I keep wondering about is whether "format readiness" ends up mattering as much as category readiness. If AI ad units can support disclosure, trust, and user control without interrupting the answer, adoption feels much more likely.

2026 seems less about reallocating search dollars and more about getting clear on what intent looks like inside an answer-based environment.

Fantastic breakdown of which industries should invest in AI media now vs later. The insight about financial services being on the bubble despite high search reliance is really intresting. I've been advising a few e-commerce brands and they're all struggling with the same question about when to shift budgets from search to AI platforms. The funnel mismatch for upper-funnel categories like automotive and CPG is a critcal point that doesnt get enough attention.